Will China Surpass the USA?

Unified industrial Planning, Foreign Investment, and Military Affairs of the Sleeping Dragon

Bottom Line up Front (BLUF)

U.S. global dominance faces Likely (60-75% probability) erosion due to structural decline from debt burdens, political polarization, and eroding multilateralism, while China's centralized model enables rapid scaling despite demographic headwinds. Given current trajectories China will Very Likely (75-85% probability) achieve asymmetric hegemony via systemic convergence by 2035, exploiting U.S. institutional decay through debt discipline, standardization advantages, and AI-enabled governance.

Asymmetric Hegemony via Systemic Convergence: 75-85% probability - China leverages debt discipline, standardization efficiency, and AI-enabled governance to reshape global norms while exploiting U.S. institutional decay from polarization, fiscal imbalances, and alliance fragmentation.

Contained Bipolarity: 10-20% probability - U.S. retains technological edge and financial market dominance but fails to counter BRI/ASEAN integration and loses ground in manufacturing competitiveness and trade relationships.

Collapse-Driven Multipolarity: 5-10% probability - Concurrent U.S.-EU debt crises fragment Western alliances while Chinese internal contradictions (demographic headwinds, debt burdens) prevent clear hegemonic succession.

Financial Analysis

China's economy reached $18.9 trillion (5% growth 2024) versus U.S. $29.2 trillion (2.8% growth), with per capita GDP gap persisting ($13,445 vs. $86,600). However, China's centralized debt management contrasts sharply with U.S. vulnerabilities: total debt exceeds 280% GDP but enables RMB 6 trillion local government refinancing and PBOC intervention (1.08% rates). U.S. federal debt reached 98% GDP in 2024, with interest payments consuming 14% federal revenue by 2025, funding non-productive expenditures (37% global defense spending, entitlement programs). China's dual circulation strategy maintains 5% growth despite trade barriers, while U.S. growth depends on volatile consumer debt ($1.2 trillion credit card balances, up 22% since 2022). Chinese R&D spending ($658 billion, 44% applied technologies) now exceeds U.S. levels ($612 billion, theoretical research emphasis). Trade dynamics: China achieved $992.2 billion surplus (exports $3.58 trillion) versus U.S. $1.15 trillion deficit, including $295.4 billion goods deficit with China despite 15.6% export surge December 2024.

Global Reserve Currency

Dollar maintains 59% global reserves but faces credibility erosion from Trump tariffs and debt concerns. U.S. sanctions overuse (3,916 entities blacklisted since 2018) accelerates dedollarization, with BRICS nations holding 32% global FX reserves in non-USD assets by 2025. Stock market capitalization shows U.S. dominance: $52 trillion (April 2025) versus China $11.87 trillion (February 2025), with superior returns (S&P 500 25.02% 2024 versus MSCI Emerging Markets 7.50%). However, ASEAN's $468.8 billion trade surplus with China locks regional economies into RMB-denominated supply chains, with 43% cross-border settlements bypassing USD. Digital yuan deployment across 29 cities (260 million wallets) represents only 0.16% monetary volume but mBridge CBDC networks challenge SWIFT system. New Development Bank provides infrastructure financing outside Western frameworks, while China's BRI/ASEAN integration creates alternative financial architectures. U.S. protectionist policies (de minimis tariffs on Chinese goods 54% May 2025) disrupt e-commerce and fragment trade relationships. The digital yuan’s 260 million wallets and mBridge CBDC network challenge SWIFT, with ASEAN’s $468.8 billion RMB-denominated trade surplus accelerating dedollarization

Geological Advantages

U.S. geological advantages: oil production 20.879 million BBL/day versus China 4.984 million, natural gas 1.029 trillion m³ versus China 225.341 billion m³. China dominates coal production (4.827 billion metric tons versus U.S. 548.849 million) and rare earth refining (87% global control). Critical Chinese vulnerability persists: 72% oil import dependency, 80% via Malacca Strait. However, China's hydrogen infrastructure pilots target $7.5/kg production costs Northwest China by 2030 (versus U.S. $15/kg) leveraging low electricity tariffs (CNY 0.3/kWh) and state-subsidized electrolyzers. Grid-scale battery storage reaches 950 GWh by 2025. National Development Reform Commission allocates $180 billion achieving 100 million tons annual hydrogen production by 2060, while U.S. subsidies remain fragmented across 26 agencies. State-directed capital achieves 92% utilization rates strategic sectors versus 67% U.S. private equity. Wood Mackenzie projects U.S. oil/gas dominance will plateau by 2035, while China’s grid-scale battery storage (950 GWh by 2025) and rare earth refining (87% global share) secure its energy transition leverage 815. The Carnegie Report warns that U.S. over-reliance on hydrocarbons risks ceding the $6 trillion clean tech market to China, which already leads in solar exports (e.g., Pakistan’s 17 GW deployment in 2024).

Military Capabilities

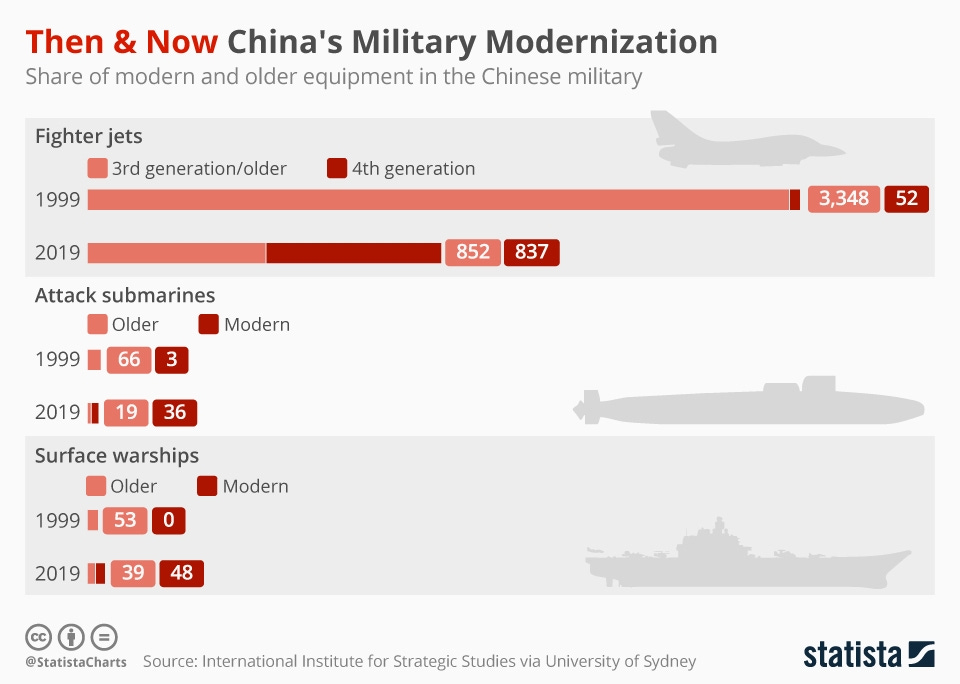

U.S. maintains military superiority with GlobalFirepower score 0.0744 (rank 1) versus China 0.0788 (rank 3), driven by 11 aircraft carriers versus China's 3, superior air/naval power. Defense spending: U.S. $886 billion (3.5% GDP) versus China's estimated $330-700 billion. Nuclear arsenals: U.S. 5,550 warheads versus China's growing stockpile (410 warheads, over 600 by mid-2024). However, China's manpower advantage (2.035 million active versus U.S. 1.328 million) and modernization focus narrow capabilities gap. Chinese naval expansion (355 ships), hypersonic missiles, cyber capabilities, and civil-military fusion in AI robotics (AgiBot potential humanoid soldiers) offset personnel shortages. Autonomous systems projected 40% of PLA capabilities by 2035. BeiDou-3 system (2.5m precision versus GPS 5m) dominates 137 BRI nations. Arctic investments (Yellow River Station, Yamal LNG) secure energy routes and dual-use surveillance infrastructure. Cyber espionage (#5 risk by 2027) and China’s BeiDou-3 system (2.5m precision) are critical asymmetric tools.

Technological Competition

U.S. dominates R&D (2.8% GDP) and leads AI, semiconductors, quantum computing, but export controls risk fragmenting global tech ecosystems. China achieves 10% annual semiconductor production growth, with SMIC 5nm development 2025-2026, though persistent foreign dependencies remain. Educational advantages: China enrolls 47.6 million university students (3,074 institutions, 97% literacy) versus U.S. 19 million, training 450,000 engineers annually via China-ASEAN University Consortium. "Thousand Talents Plan" repatriates 68% overseas Chinese STEM PhDs while U.S. visa restrictions (down 40% since 2022) accelerate reverse migration. China Standards 2035 reduces production costs 12-15% through unified technical norms versus U.S. regulatory fragmentation adding $1.2 trillion compliance overhead. Total Factor Productivity growth: China 2-3% projected 2025 versus U.S. 0.5-1%, indicating efficiency catching-up despite lower baseline levels. Digital yuan trials in 26 cities target 15% global reserves by 2035, challenging dollar dominance (currently 59% reserves versus RMB 3%). By unifying technical norms (e.g., AI, 5G, IoT), China reduces production costs by 12–15% while forcing foreign firms to adapt, as seen in sectors like renewable energy and digital infrastructure 411. For instance, Huawei’s dominance in ICT patents (3,544 in 2021) and ISO/IEC proposals (20% annual growth) positions China to shape global tech ecosystems, creating dependencies that bypass U.S. export controls. The U.S. CHIPS Act focuses on reshoring, yet regulatory fragmentation (26 agencies overseeing subsidies) contrasts with China’s state-directed capital (92% utilization in strategic sectors). Taiwan controls 92% advanced semiconductor manufacturing through TSMC. Potential conflict would disrupt global supply chains, accelerate U.S./EU reshoring. Chinese reunification calculus partly driven by strategic semiconductor asset control desire.

Space Program Capabilities

Chang'e-6 lunar mission completed, Chang'e-7 planned 2025. International Lunar Research Station partnership with Russia. Low Earth Orbit (LEO) satellite integration enhances global digital influence. China's space program has achieved significant milestones, with the Chang'e-6 lunar mission successfully completed in 2024, collecting 1,935.3 grams of samples from the far side of the Moon. The Chang'e-7 mission is scheduled for launch in 2026, targeting the lunar south pole for resource exploration. China is advancing the International Lunar Research Station (ILRS) in collaboration with Russia, aiming for operational status by 2035. The country has deployed over 600 satellites in Low Earth Orbit (LEO), including the Qianfan constellation, enhancing global communication and surveillance capabilities. China's space budget reached $14.7 billion in 2024, with plans for 100 launches in 2025.

Robotics

Robotics advancement demonstrated through world's first humanoid robot kickboxing competition. China’s robotics sector (fastest-growing globally) targets 40% PLA automation by 2035 and "precision assembly" in manufacturing, offsetting labor shortages. This includes deploying over 1,000 unmanned aerial vehicles (UAVs) and 500 autonomous ground vehicles by 2024, with applications in reconnaissance, logistics, and combat. AI-driven eldercare platforms and humanoid robots (e.g., AgiBot) could redefine productivity. China's robotics industry leads globally, with a market size of $17.4 billion in 2024 and an annual growth rate of 22%. The country hosted the world's first humanoid robot kickboxing competition in 2024, showcasing advancements in AI-driven robotics. The 14th Five-Year Plan targets 40% automation in the People's Liberation Army (PLA) by 2035 and emphasizes "precision assembly" in manufacturing to address a labor force decline of 5.6 million workers annually. Companies like AgiBot produce humanoid robots for eldercare and industrial applications, with 1.2 million units installed nationwide in 2024.

Biotechnology

Contributes 23% global drug pipeline. 14th Five-Year Plan for Bioeconomy Development includes biomedicine/bio-security goals with potential dual-use military applications requiring deeper analysis. China's biotechnology sector accounts for 23% of the global drug pipeline, with 1,200 clinical trials active in 2024. The 14th Five-Year Plan (2021–2025) prioritizes biomedicine and bio-security, allocating $60 billion to develop gene-editing, synthetic biology, and vaccine production. Over 400 biotech firms operate in the Beijing-Tianjin-Hebei region, with exports valued at $8.3 billion in 2024. Dual-use applications, including CRISPR-based research, raise concerns about potential military use, as 15% of biotech funding is linked to defense programs.

Labor Markets and Demographic Challenges

U.S. unemployment 4.2% (April 2025) but youth unemployment reaches 12.9%, with labor resilience in tech/services contrasting declining manufacturing competitiveness. China maintains urban unemployment 5.1% (2024) but persistent youth unemployment 15.8% (April 2025), with overqualified graduates flooding low-wage sectors (25% delivery drivers hold degrees). Demographic pressures: China's aging crisis (21% population 60+) produces 21.3 million reaching military age annually, while gender imbalance creates 34 million excess males under 20. Educational mismatch despite 47.6 million university enrollment suggests systemic inefficiencies. Regional disparities persist with rural-urban income gaps (3:1 ratio) despite poverty alleviation campaigns. Environmental costs consume 6% GDP annually through air/water pollution, constraining sustainable development and public health outcomes.

Geopolitical Influence

U.S. allies account for 28% global GDP (PPP) versus China's 5%. Neutral states represent 20% global GDP as pivotal swing influence. BRICS New Development Bank and Shanghai Cooperation Organisation expanding as Western alternatives. SCO now includes Iran/Belarus under Chinese leadership. Brazil-China agreements covering agriculture/mining/energy amid U.S.-China trade tensions. African space sector engagement enhances surveillance capabilities and regional positioning. China mediated Saudi-Iran détente demonstrating diplomatic capacity. Vaccine diplomacy expanded Global South influence. Belt and Road Initiative shifting toward "Digital Silk Road" emphasizing digital infrastructure and green technologies, facing stalled projects and debt renegotiations requiring strategic adaptation. China’s $180 billion hydrogen investment and smart grid exports to Central Asia/GCC nations illustrate how BRI now prioritizes climate tech, aligning with Global South demands for sustainable development 1115. Concurrently, stalled BRI projects (e.g., Pakistan’s CPEC) are being renegotiated with debt-for-equity swaps, deepening economic leverage 15.

Soft Power

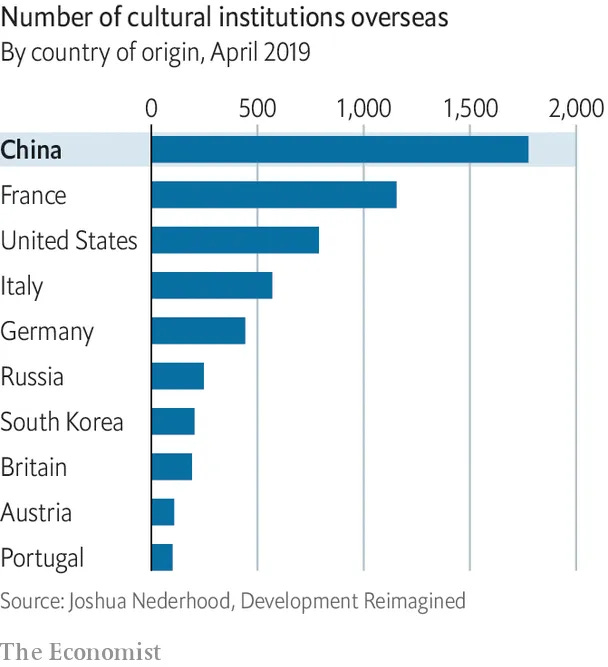

Overtook UK for second place Global Soft Power Index 2025 through strategic culture/media/education/science/sustainability investments. TikTok: 1.6 billion monthly users worldwide 2025 serving as significant cultural influence conduit across diverse demographics. CGTN state media effectively shapes developing country perceptions. Confucius Institutes downsizing in West (North America/Europe closures) while expanding Global South (Africa/Latin America remain active). Sports diplomacy through 2022 Winter Olympics and football investments. Cultural initiatives promote "Tianxia" concept of harmonious world order under Chinese leadership. Global Civilization Initiative promotes multipolar world order through cultural exchanges and visa-free entry programs.

Internal Governance

China's centralized governance ensures policy continuity through 10-year leadership cycles, contrasting U.S. election-driven volatility (74 regulatory reversals post-2024). AI-driven judicial standardization reduces legal case backlogs 61% since 2022 versus U.S. court delays costing $420 billion annually. ESG mandates for SOEs target 70% disclosure compliance by 2027, while mandatory sustainability reporting for Shanghai/Shenzhen exchanges aims similar rates. Patriotic Education Campaigns foster 82% public approval for CCP policies versus U.S. institutional distrust 58% (2025). However, vulnerabilities persist: post-Xi succession uncertainty post-2027, youth disillusionment ("lying flat" movement), rural-urban GDP disparities (3:1 ratio). U.S. faces deeper structural challenges: wealth inequality (top 1% hold 32-38% assets), political polarization (74% view democracy "dysfunctional"), far-right movements resembling pre-civil war indicators. Chinese regional disparities (Shanghai $27k versus Gansu $5k) addressed through rural revitalization allocating 12% provincial budgets to infrastructure upgrades. The Global Risks Report 2025 ranks misinformation/disinformation as the #1 risk by 2027, exacerbated by AI-generated content that China could weaponize to destabilize adversaries or consolidate domestic control 3. Meanwhile, U.S. societal polarization (ranked #4 risk) undermines its capacity for cohesive policy responses, as regulatory reversals and election volatility erode trust.

End of Brief.