Bottom Line Up front (BLUF)

Institutional consensus response to de-dollarisation asserts that there aren't currently any viable reserve-currency – while it is unlikely that another currency, like the Chinese Renminbi (CNY) will replace United States Dollar (USD) dominance – data indicates a structural transformation from unipolar dollar dominance to currency multipolarity in the global monetary system. This transition, represents a fundamental shift away from the 80-year Bretton Woods II framework toward a decentralised system characterised by diverse currency usage in international trade, investment, and reserves – utilising existing domestic currencies rather than adopting a new hegemonic alternative (CNY, BTC, etc.) .

I. Current Dollar Hegemony Metrics and Degradation Patterns

A. Reserve Currency Share Decline

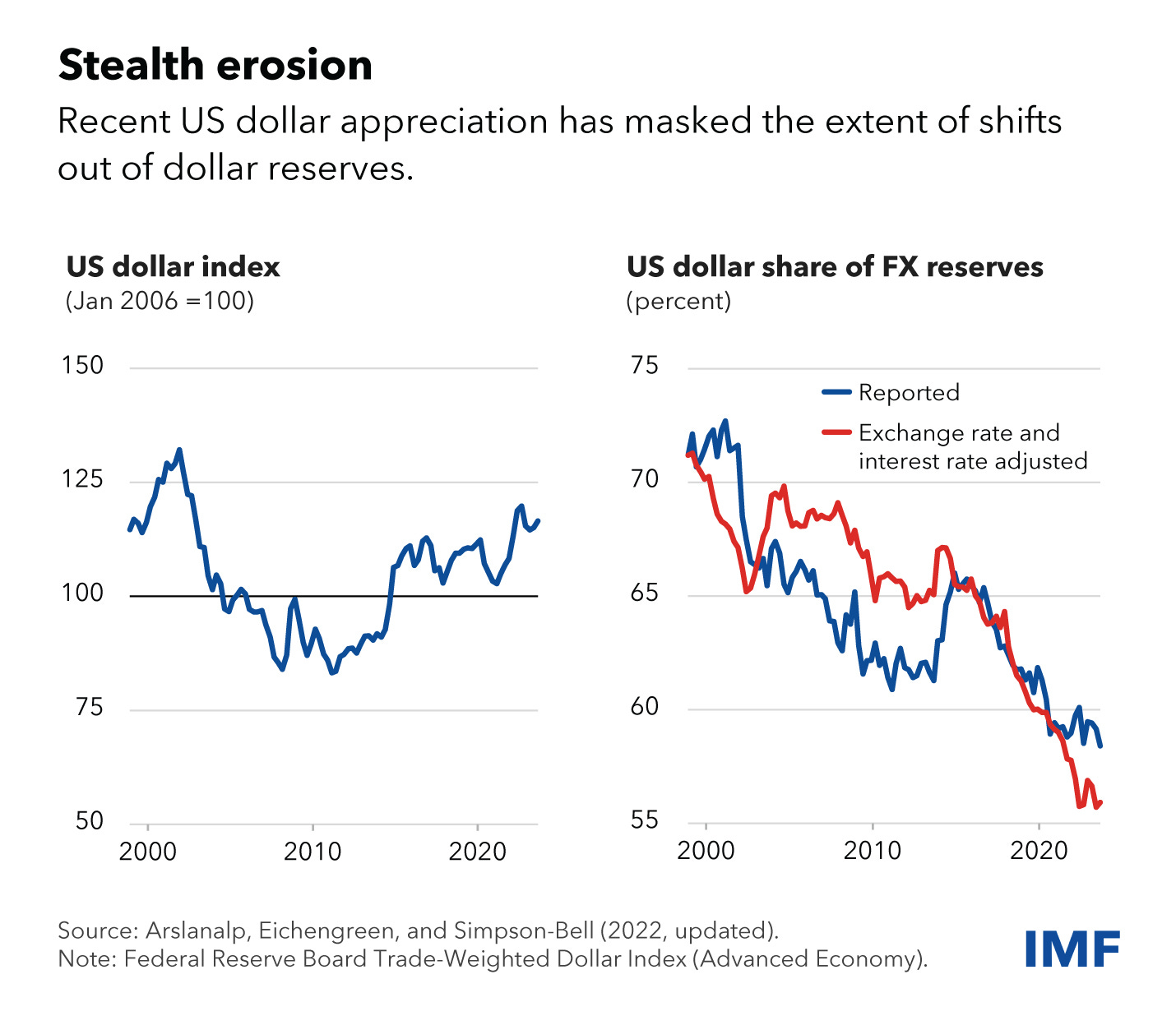

USD share of global foreign exchange reserves: 71% (1999) → 58% (2022)

Continuous 14-year declining trajectory representing 1.09% annual erosion rate

Accelerated decline post-2014, correlating with increased sanctions implementation

B. Trade Settlement Transformation

China's Bilateral Trade Patterns:

Yuan usage in China's cross-border transactions reached 48.4% in March 2023, with cross-border payments totaling $549.9 billion

China-Russia trade value reached record 1.74 trillion yuan ($237 billion) in 2024

Approximately 53% of China's total trade now conducted in yuan through domestic payment systems and currency swaps

Central Bank Currency Swap Infrastructure:

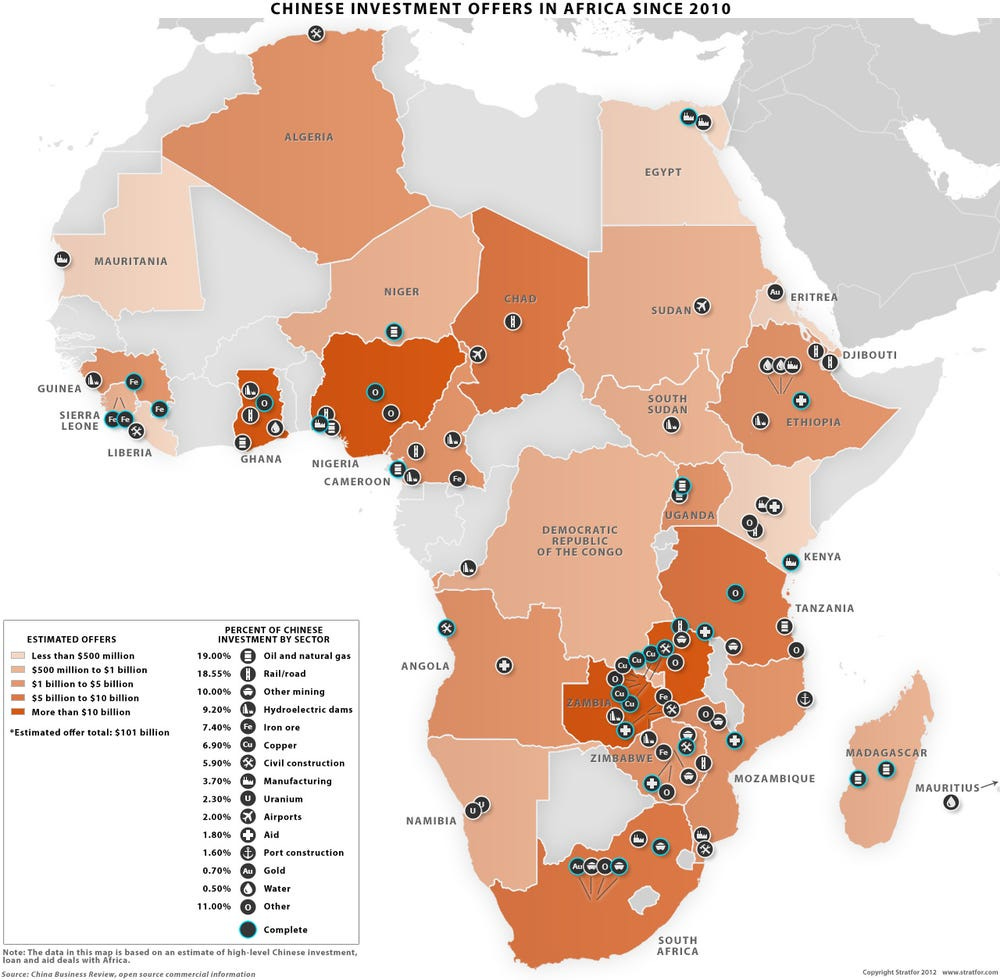

China has established bilateral currency swap agreements with 29 countries/regions totaling 4 trillion yuan ($553.49 billion)

China-Nigeria currency swap renewed at 15 billion yuan ($2 billion) in December 2024

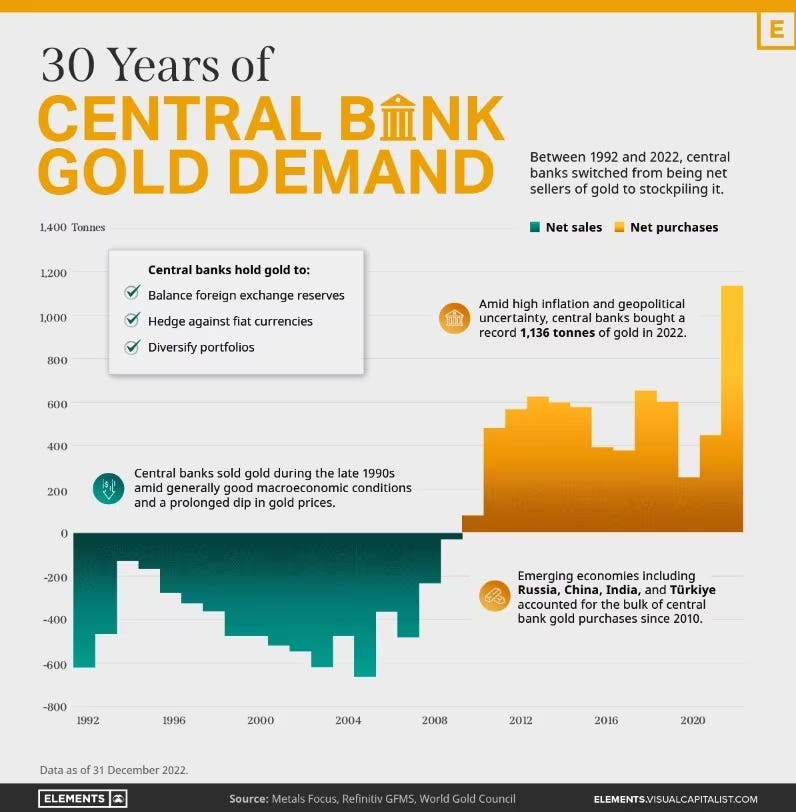

C. Gold Reserve Accumulation Patterns

Central banks added 1,045 metric tons to global gold reserves in 2024, marking the third consecutive year exceeding 1,000 metric tons annually

BRICS+ controls 42% of global central bank FX reserves, contributing to global de-dollarization processes with gold as the primary dollar alternative

II. Structural Drivers of Transition

A. Sanctions as Catalyst Mechanism

Quantitative Impact Assessment:

14,000+ sanctions imposed on Russia accelerated dedollarization across 150+ countries representing 7 billion population

Russia's ruble-for-energy mandate (2022) resulted in ruble becoming best-performing currency of 2022

Russian economy stabilization despite sanctions demonstrated multicurrency system viability despite real estate deflation and Western financial exclusion

Geopolitical Response Patterns:

UN Resolution condemning unilateral sanctions (December 2022) indicates global South consensus

80+ countries now prioritize local currency trade to mitigate sanctions exposure

B. Economic Security Considerations

Reduced Compliance Costs:

Local currency transactions eliminate AML/CTF overhead from cross-border banking complexities

Elimination of sanctions-related due diligence requirements for domestic currency transactions

Reduced foreign exchange hedging costs and cross-border banking intermediation fees

Enhanced Fiscal Capacity:

Local currency pricing improves tax/tariff collection visibility

Reduction in offshore dollar-based tax evasion through dual-pricing mechanisms

Enhanced export revenue transparency for domestic taxation

III. Multicurrency Framework Analysis

A. Operational Structure

No Hegemonic Replacement Model:

System utilizes ALL existing currencies rather than establishing new dominant currency

Eliminates need for G7 consensus or IMF/World Bank institutional reform

Bilateral agreements circumvent Western institutional veto mechanisms

Vostro Account Infrastructure:

Regional vostro accounts (Russian rubles, Chinese yuan) settle cross-border transactions

Bypasses Western banking infrastructure (SWIFT alternatives)

Domestic payment system interoperability replaces global payment system creation

B. Implementation Mechanics

Incremental Adoption Strategy:

Sector-specific testing (Russia's energy-for-rubles model)

Gradual expansion from commodity trade to comprehensive bilateral commerce

Adaptation of existing financial infrastructure rather than new system construction

Legal Framework Adaptation:

State-level legislation enabling local currency payments

Regulatory modifications for domestic banking operations

Corporate accounting system adjustments for multicurrency operations

IV. Economic Impact Assessment

A. Macroeconomic Stability Indicators

Exchange Rate Volatility Reduction:

Local currency revenues create more predictable debt servicing capacity

Reduced forex exposure for export-dependent economies

Enhanced monetary policy autonomy for participating nations

Credit Rating Implications:

Improved debt service capacity through currency matching

Enhanced fiscal revenue collection improving sovereign credit metrics

Reduced external vulnerability to currency volatility

B. Trade Efficiency Metrics

Transaction Cost Reduction:

Elimination of USD intermediation fees

Reduced hedging requirements for bilateral trade

Lower compliance costs for domestic banking institutions

Market Access Enhancement:

SME exporters gain access previously limited by commercial trade finance constraints

Reduced banking capacity requirements for cross-border transactions

Enhanced financial inclusion for smaller market participants

V. Geopolitical Ramifications

A. US Strategic Position Degradation

Monetary Policy Transmission:

Reduced global impact of Federal Reserve policy decisions

Diminished dollar demand reducing seigniorage benefits

Potential increase in US borrowing costs due to reduced Treasury demand

Sanctions Effectiveness Erosion:

Alternative payment systems reduce sanctions compliance pressure

Bilateral trade agreements create sanctions-resistant commerce channels

Reduced leverage for economic coercion through financial system exclusion

B. Emerging Market Empowerment

Enhanced Negotiating Position:

Reduced dependency on Western financial institutions

Increased bargaining power in bilateral trade negotiations

Greater monetary policy independence from Federal Reserve decisions

Regional Integration Acceleration:

Currency unions and regional payment systems development

Enhanced South-South cooperation through direct currency exchange

Reduced reliance on Western financial intermediation

VI. Risk Assessment

A. Transition Risks

Liquidity Constraints:

Limited depth in non-dollar currency markets

Potential volatility during transition periods

Infrastructure development requirements for full implementation

Coordination Challenges:

Multiple bilateral agreements create complex web of arrangements

Potential for exchange rate manipulation disputes

Technical integration difficulties between domestic payment systems

B. Systemic Vulnerabilities

Credit Rating Limitations:

BRICS credit rating agency faces data inconsistency challenges

USD dependencies in rating methodologies persist

Regulatory barriers to alternative rating system acceptance

Legal Framework Gaps:

Supranational systems (BRICS Clear) lack neutral jurisdiction for asset settlement

Dispute resolution mechanisms underdeveloped

Regulatory harmonization requirements across participating nations

VII. Probability Assessment and Timeline Projections

A. Short-term Developments (2025-2027)

High Probability Events:

Continued expansion of bilateral currency swap agreements

Increased commodity trade settlement in local currencies

Further development of regional payment system integration

Medium Probability Events:

Establishment of BRICS clearing and settlement infrastructure

Significant expansion of yuan usage in Belt and Road Initiative countries

Creation of alternative credit rating mechanisms

B. Medium-term Evolution (2027-2035)

Structural Changes:

Dollar share of global reserves declining to 40-45% range

Local currency trade comprising 60-70% of emerging market bilateral commerce

Established alternative financial infrastructure achieving critical mass

Institutional Developments:

Functional BRICS+ financial institutions operating independently

Regional monetary coordination mechanisms

Reduced Western institutional influence over global financial governance

VIII. Strategic Implications for Stakeholders

A. For Emerging Economies

Opportunities:

Enhanced monetary sovereignty and reduced external vulnerability

Improved terms of trade through direct currency exchange

Strengthened fiscal capacity through enhanced tax collection

Requirements:

Development of domestic financial market depth

Investment in payment system infrastructure

Legal framework modernization for multicurrency operations

B. For Developed Economies

Challenges:

Reduced monetary policy transmission globally

Diminished financial sector advantages from dollar intermediation

Potential increase in funding costs for government and corporate debt

Adaptation Strategies:

Development of competitive advantages in non-dollar financial services

Enhanced bilateral economic relationships with emerging markets

Investment in alternative financial technology infrastructure

IX. Conclusion

The international monetary system is undergoing fundamental restructuring from dollar dominance to multipolarity, driven by geopolitical tensions, economic security needs, and technological advances enabling bilateral currency exchange. Unlike historical transitions that replaced one hegemonic currency with another, this transformation involves diverse currency proliferation without establishing a single dominant alternative.

Key Indicators: Russia's economic stabilization despite comprehensive sanctions, China's 53% yuan usage in international trade, and extensive bilateral currency swap networks demonstrate the system's viability. The process is incremental, using existing financial infrastructure rather than requiring new institutions, making it resistant to Western vetoes.

Success Factors: Enhanced fiscal transparency and tax collection, reduced transaction costs and sanctions exposure, improved debt service through currency matching, and elimination of dollar intermediation fees. The transition proceeds through bilateral agreements and domestic regulatory changes without requiring G7 consensus.

Timeline Projections: Continued acceleration through 2035, with dollar reserve share potentially declining to 40-45% and local currency trade comprising majority of emerging market bilateral commerce. This represents evolution rather than collapse—the dollar becomes one alternative among many rather than the singular dominant medium.

Strategic Implications: Enhanced monetary sovereignty for emerging economies, reduced Western leverage through financial sanctions, and fundamental rebalancing of global economic power. Success depends on continued alternative financial infrastructure development, macroeconomic stability maintenance during transition, and effective coordination among participating economies without centralized institutional control.