Space War

Space-Based Intelligence, Surveillance, and Reconnaissance (ISR); Evolution from Combat Support to Warfighting Domain

EXECUTIVE SUMMARY

Space-based Intelligence, Surveillance, and Reconnaissance (ISR) has undergone fundamental transformation from passive intelligence collection to active warfighting capability. Current assessment indicates space operations now constitute a contested domain where ISR assets serve dual roles as intelligence platforms and tactical enablers for multi-domain operations. Analysis reveals accelerating militarization across all orbital regimes, with state and non-state actors developing counter-space capabilities that threaten existing ISR architectures.

Key findings indicate transition from Cold War-era film-return reconnaissance to real-time digital targeting systems, commercial-military integration reaching 40% of remote sensing capacity, and emergence of gray-zone warfare targeting space assets through non-kinetic means. Current trajectory suggests space superiority will determine terrestrial campaign outcomes by 2030.

SECTION I: HISTORICAL EVOLUTION AND CURRENT CAPABILITIES

A. GENESIS AND EARLY DEVELOPMENT (1960-1991)

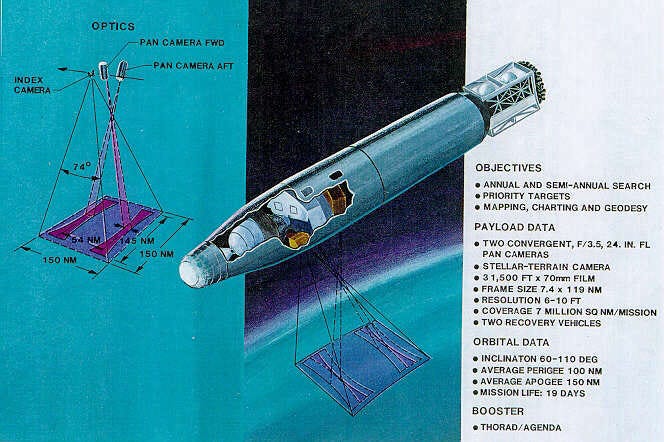

Corona Program Foundation (1960s)

First operational space-based ISR system utilizing film-return capsules

Processing timeline: weeks from collection to analysis

Operational necessity established following 1960 U-2 shootdown over Soviet Union

Strategic reconnaissance focus on nuclear facilities and military installations

Digital Revolution Transition (1970s-1980s)

Elimination of film retrieval requirements through digital sensor integration

Near-real-time data transmission capability development

Defense Reconnaissance Support Program (DRSP) establishment by Congress in 1980

Mission scope: satellite reconnaissance support modification, augmentation, and new system acquisition

DRSP redesignation to Defense Space Reconnaissance Program (DSRP) in late 1990s

Gulf War Paradigm Shift (1991)

Designated "First Space War" due to satellite imagery-guided precision strikes

Battlefield planning integration of space-based intelligence

Demonstration of space ISR tactical utility beyond strategic intelligence collection

B. CURRENT SPACE ISR ARCHITECTURE

Orbital Distribution and Platform Types

Geostationary Earth Orbit (GEO) Assets:

Persistent coverage over specific geographic regions

Communications relay and missile warning systems

35,786 km altitude providing 24-hour orbital period

Defense Support Program (DSP) and Space-Based Infrared System (SBIRS) constellation

Low Earth Orbit (LEO) Constellation:

Altitude range: 160-2,000 km

Enhanced resolution and reduced latency

Proliferated Warfighter Space Architecture (PWSA): 300-500 satellite network planned

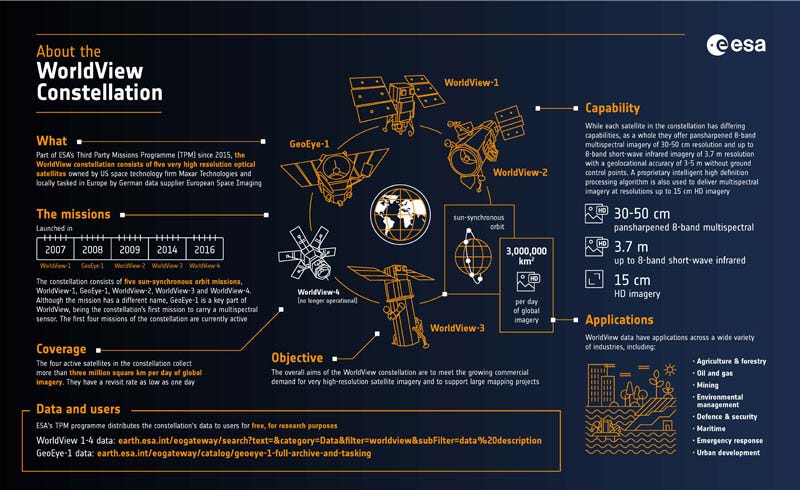

Commercial integration: Planet Labs (150 satellites), Maxar WorldView Legion, BlackSky constellation

Medium Earth Orbit (MEO) Systems:

Global Positioning System (GPS) constellation: 24 operational satellites

GLONASS (Russia): 24 satellites

BeiDou (China): 35 satellites

Galileo (European Union): 24 satellites

Sensor Technologies and Capabilities

Electro-Optical/Infrared (EO/IR) Systems:

Maxar's WorldView constellation: up to 40 daily revisits capability

BlackSky: 80 cm resolution imagery

Real-time tactical support through mobile terminals

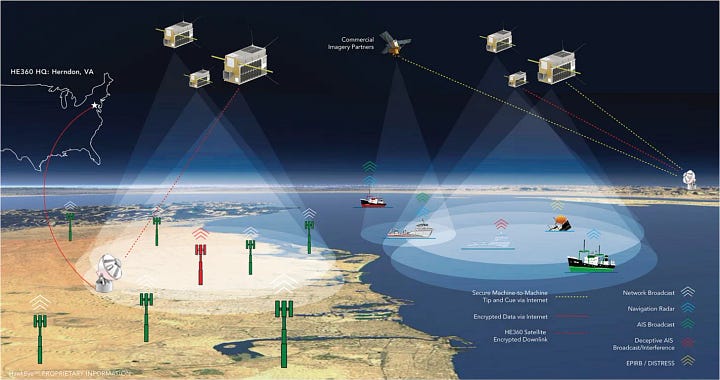

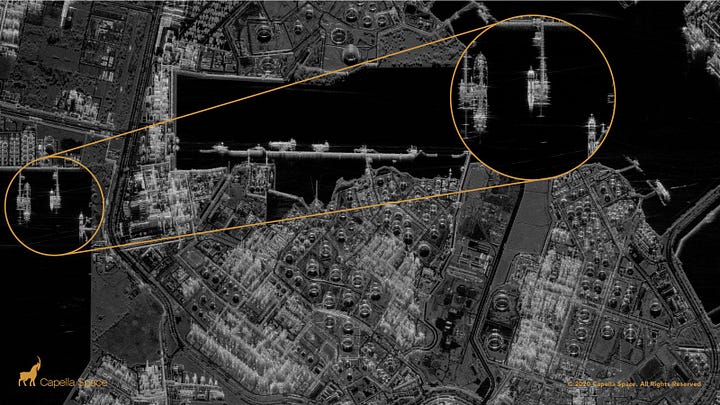

Synthetic Aperture Radar (SAR):

Weather-independent imaging capability

Capella Space: 7 operational satellites

ICEYE constellation: 13 satellites

MDA's Radarsat-2 tactical support integration

Signals Intelligence (SIGINT):

Electronic emissions collection and analysis

HawkEye360: National Reconnaissance Office (NRO) contract for GPS interference monitoring

Pre-Ukraine invasion threat assessment capability demonstrated

Multi-Phenomenology Integration:

Maxar, Ursa, and MINT systems development

HySpecIQ hyperspectral imaging: NRO contract awarded 2019; delivers hyperspectral imagery at 5-meter resolution, enabling material identification and camouflage penetration beyond standard EO/IR

Cross-platform data fusion for enhanced intelligence picture

C. TACTICAL DEPLOYMENT EXAMPLES

Eagle Vision Capability (Operation Iraqi Freedom 2003)

Deployable satellite downlink stations

Commercial imagery processing in near real-time

Mass gravesite identification near Baghdad: 12-hour timeline

50% reduction compared to conventional intelligence methods

Tactical Space Layer Implementation (2021)

Space Force approval for rapid experimentation and prototyping

Commercial satellite imagery integration

Maxar mobile terminals: real-time EO imagery delivery

Beyond-line-of-sight targeting support

Battlespace awareness enhancement for tactical commanders

SECTION II: TRANSITION TO WARFIGHTING DOMAIN

A. DOCTRINAL EVOLUTION

U.S. Space Force Doctrine Development

Space Force Doctrine Document 1 (SFDD-1) released 2025

Space superiority definition: "freedom from prohibitive interference"

Operational segments: terrestrial, link, and orbital

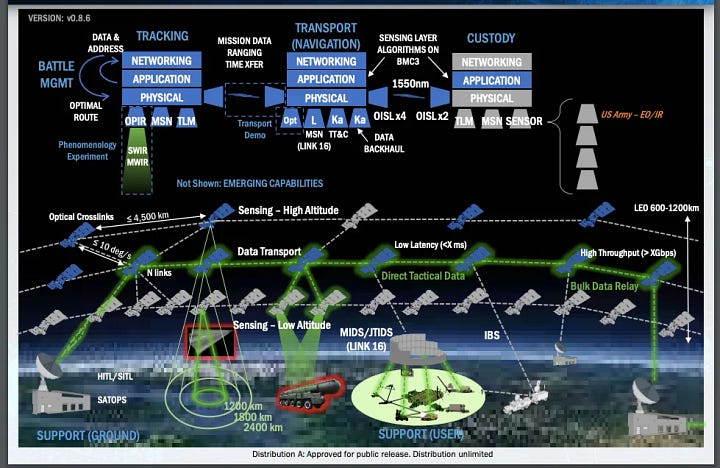

Multi-Domain Integration: C4I2SR (Command, Control, Communications, Computers, Information, Intelligence, Surveillance, Reconnaissance)

OODA loop (Observe-Orient-Decide-Act) integration

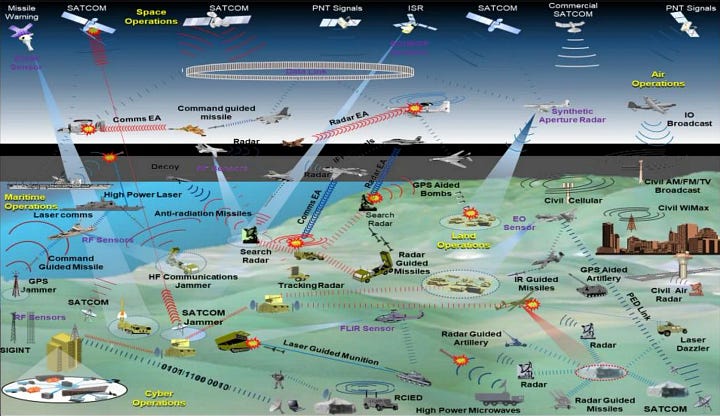

Space Warfighting Framework (2025)

Three mission areas defined:

Orbital Warfare

Electromagnetic Warfare

Cyberspace Warfare

Global power projection enablement

Space superiority as prerequisite for terrestrial operations

U.S. Space Command (USSPACECOM) Priorities

2025 designated "Year of Command and Control"

Strategic C2 concept revitalization

Commercial and allied capability integration

Joint All-Domain Command and Control (JADC2) integration

B. ORGANIZATIONAL STRUCTURE AND CAPABILITIES

U.S. Space Force Components

Space Warfighting Analysis Center (SWAC):

Activated 5 April 2021

Mission areas: missile warning, missile tracking, missile defense architecture

Ground Moving Target Indicator (GMTI), Space Data Transport, Position Navigation and Timing (PNT)

Tactical ISR and Space Domain Awareness (SDA)

Counterpart to Air Force Warfighting Integration Capability and Army Futures Command

ISR Integrated Process Team (IPT):

Initiated 2022 under Lt. Gen. Bill Liquori leadership

Joint space-based ISR and sensing requirements coordination

Gap analysis with traceable documentation of joint warfighter requirements

Intelligence Community integration: NRO and National Geospatial-Intelligence Agency (NGA)

Commercial product and data integration for national security applications

Space Development Agency (SDA):

Transport Layer constellation development

LEO satellite network for assured, resilient, low-latency military connectivity

Global coverage and warfighter platform support

U.S. Army Space Integration

1st Space Brigade: global space support, space control, space force enhancement operations

Army Space Vision (January 2024): four consequential mission areas

Intelligence, Surveillance, and Reconnaissance (ISR)

Positioning, Navigation, and Timing (PNT)

Satellite Communications (SATCOM)

Missile Warning

Forward edge of battle space capability co-location and maneuver with ground forces

Adversary ISR interdiction capability development;

NASA-ISRO NISAR Mission: This joint project, set for 2025, will map Earth with dual-frequency radar, improving ISR for natural hazards and ecosystem monitoring. Scheduled for launch in 2025, NISAR will be the first radar imaging satellite to use dual frequencies (L-band and S-band), providing high-resolution mapping of Earth's surface. With a resolution of 5 to 10 meters and a 12-day global mapping cycle, it is designed to observe and measure complex natural processes, including ecosystem disturbances, ice-sheet collapse, and natural hazards such as earthquakes, tsunamis, volcanoes, and landslides.

C. COMMERCIAL-MILITARY INTEGRATION

Commercial Space ISR Contribution

40% of remote sensing assets commercial origin

SpaceX Starlink: $1.8 billion NRO contract

Dual-use technology proliferation across military and civilian applications

Commercial innovation driving military capability advancement

Commercial Constellation Capabilities

Planet Labs: 150 satellite constellation

Maxar WorldView Legion: 40 daily revisits capability

BlackSky: 80 cm resolution imagery

Capella Space SAR: 7 operational satellites

ICEYE SAR constellation: 13 satellites

Space Force Training and Exercises

Space Flag exercises: tactical space units advanced training in contested environments

Provides space combat power training for operational readiness

Artificial Intelligence Integration

NRO utilizes AI to process multi-source ISR feeds

Automated threat detection and data fusion acceleration

Decision cycle enhancement through machine learning algorithms

Advanced Countermeasures

Eichelberger Collective Detection (ECD): GPS spoofing mitigation through cross-satellite signal correlation

Anti-jamming waveform development for secure communications

Programs

Space Force satellite-based Ground Moving Target Indicator (GMTI) program revealed May 2021

Designed to replace aging Joint Surveillance Target Attack Radar System (JSTARS) aircraft

2022 National Defense Authorization Act (NDAA) limited GMTI spending to ≤75% of planned annual budgets

Congressional concerns regarding potential redundancies addressed by Adm. Christopher Brady report requirement

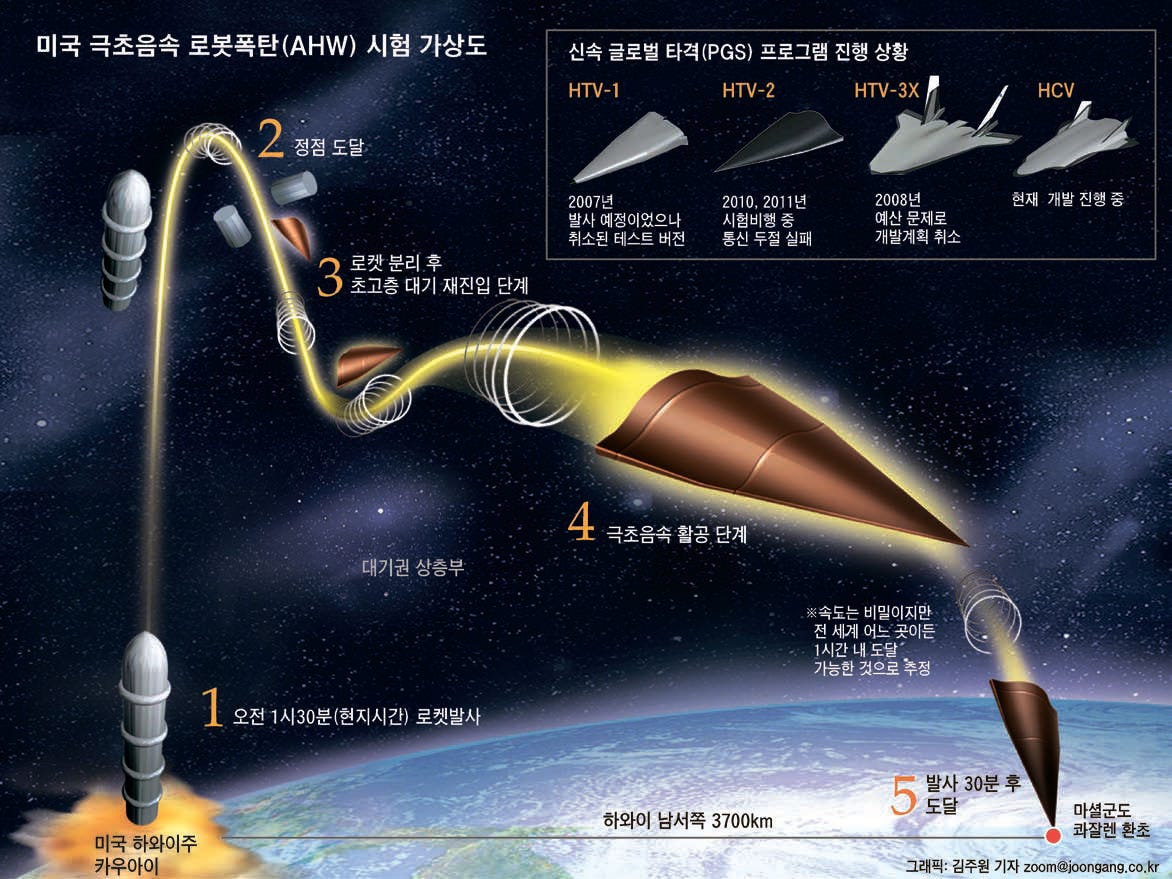

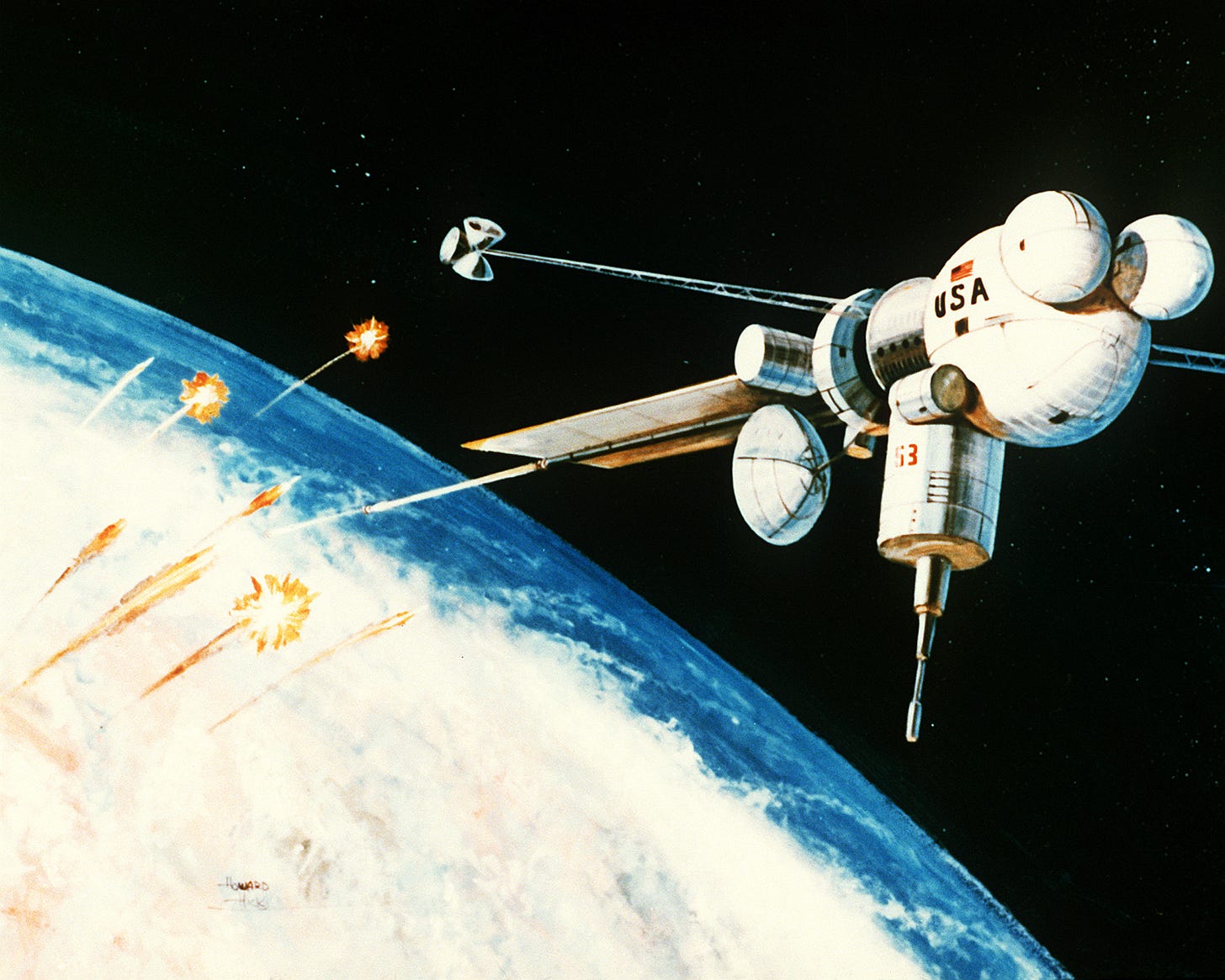

Space-Based Global Strike Concepts

Air Force Rocket Cargo program: suborbital cargo delivery capability

Point-to-point transit capability: <90 minutes globally using reusable rockets

Orbital warehousing systems for rapid logistics deployment

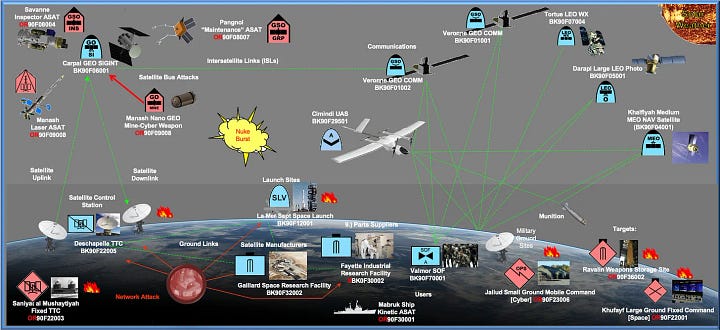

SECTION III: EMERGING THREATS AND GRAY-ZONE WARFARE

A. NON-KINETIC ATTACKS ON SPACE ASSETS

Electronic Warfare Targeting

GPS/GNSS spoofing and jamming operations

Satellite communication disruption

Ground station electronic attack

Laser dazzling of optical sensors

Spectrum vulnerability exploitation: jamming and spoofing degrade targeting and navigation

Adversaries exploit gaps in U.S. electromagnetic spectrum dominance

Cyber Warfare Against Space Infrastructure

Russia 2022 Viasat hack: Ukrainian command structure disruption

Wagner Group 2023 coup attempt: satellite system compromise

Chinese cyber operations against Japanese space agency

Ground station vulnerabilities exploitation

Russian Operations Pattern Analysis

Ukraine invasion: initial satellite infrastructure targeting

Communication satellite priority targeting

GPS interference campaigns

Plausibly deniable civilian/commercial cover operations

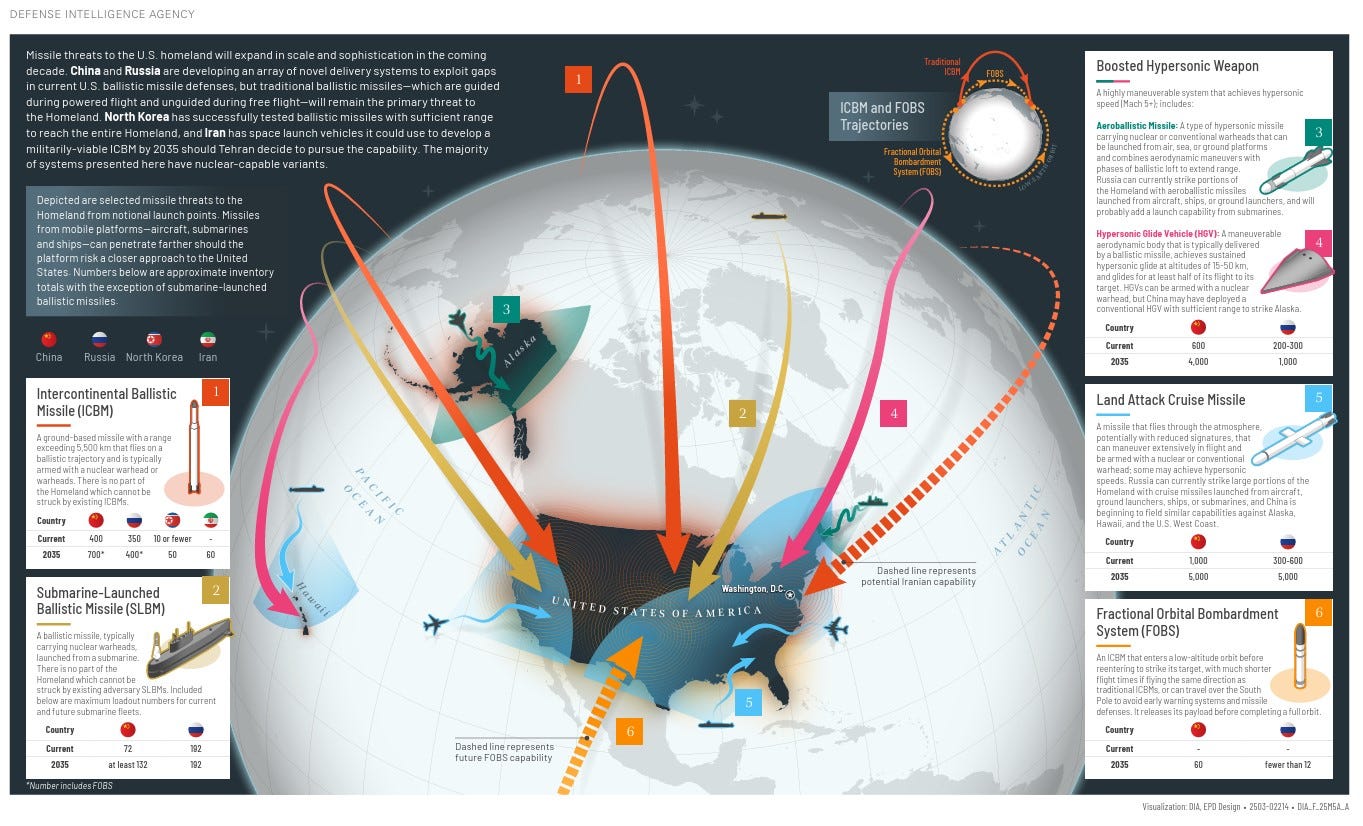

B. KINETIC ANTI-SATELLITE (ASAT) CAPABILITIES

Demonstrated ASAT Systems

China:

2007 ASAT test: Fengyun-1C weather satellite destruction

2021 Fractional Orbital Bombardment System (FOBS) test

Debris field creation: ongoing threat to orbital assets

People's Liberation Army (PLA) Aerospace Force development

December 2023: revealed classified space combat simulator details to address PLA space threat apprehensions

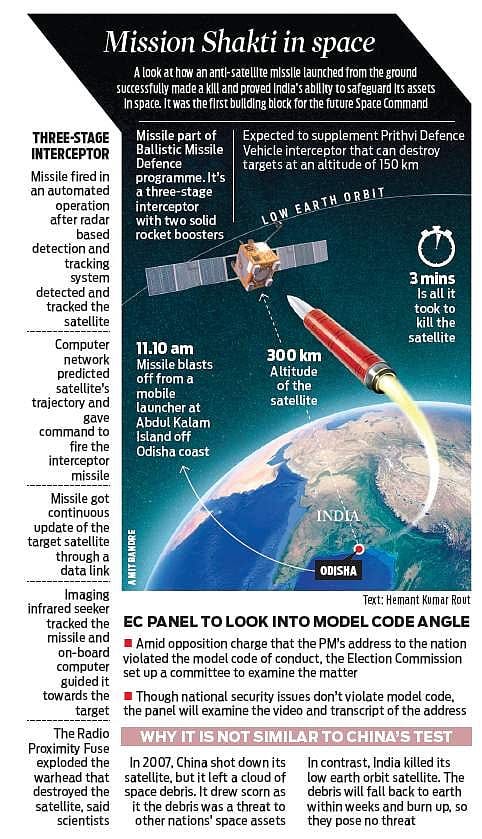

India: Following Operation Sindoor on May 7, 2025, India is enhancing satellite-based ISR to boost coverage, likely due to recent counterterrorism needs. Operation Sindoor was a military response to a terrorist attack on April 22, 2025, in Pahalgam, where 26 civilians were killed, attributed to Pakistan-backed groups like The Resistance Front (TRF), a proxy of Lashkar-e-Taiba.

2019 Mission Shakti: successful ASAT demonstration

283 km altitude intercept capability

Regional space power status establishment

Russia:

Multiple ASAT test programs

Declining space power seeking strategic leverage

Nuclear-capable orbital weapon development reports

United States:

Historical ASAT capability demonstration

Current defensive system development priority

Arrow-2 system: first recorded combat interception outside Earth's atmosphere (October 2023)

C. ORBITAL WARFARE DEVELOPMENT

Co-Orbital Attack Capabilities

Satellite-on-satellite attack systems

Sophisticated orbital maneuvering techniques

Space-based "dogfighting" tactical development

On-orbit servicing cover for military applications

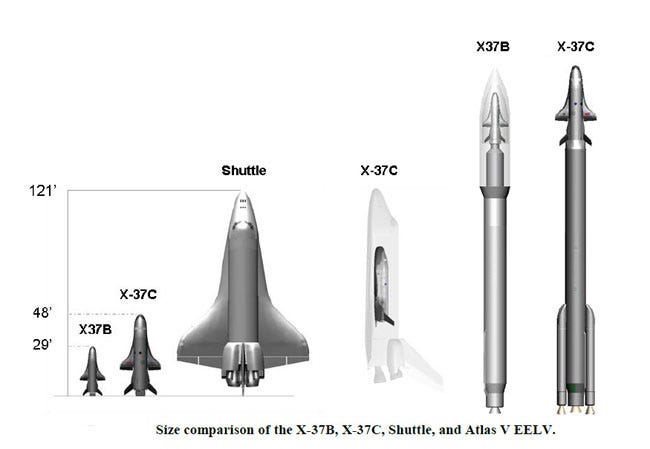

Orbital Test Vehicles

U.S. Air Force Boeing X-37B: multiple long-duration missions

Chinese equivalent systems development

Dual-use technology advancement

Plausible deniability maintenance

Emerging Orbital Weapons Concepts

"Rods from God" kinetic projectile systems

Mach-10 strike capability within minutes

Golden Dome initiative: space-based missile interceptors

Boost-phase defense extension to counter-space roles

SECTION IV: INTERNATIONAL COMPETITION AND TREATY FRAMEWORK

A. SPACE POWER COMPETITION

Chinese Space Program Advancement

December 2023: classified space combat simulator details revelation

PLA space threat apprehension addressing

BeiDou constellation: 35-satellite global coverage

Military-civilian fusion space development strategy

European Space Capabilities

France: $6.7 billion military space budget (2024-2030)

NATO Defence Innovation Accelerator for the North Atlantic (DIANA): €1 billion investment

€50 million annual budget release 2023; This first focused on defense innovation, focusing on jamming resilience

Galileo constellation: independent positioning capability

Russian Space Strategy

Declining space power status

Nuclear orbital weapon development reports

UN Security Council resolution veto: outer space treaty enforcement

Proposal for complete space weapons removal (subsequently vetoed by U.S.)

B. LEGAL AND TREATY FRAMEWORK

Outer Space Treaty (1967) Limitations

Nuclear weapons in space prohibition

Outdated framework for current warfare needs

Weapon deployment restrictions

Policy modernization requirements

Current Treaty Enforcement Challenges

Russian UN Security Council resolution veto

Nuclear orbital weapon development reports

Treaty revision necessity for defensive space weapons

Debris-generating ASAT ban requirements

SECTION V: CURRENT THREAT ASSESSMENT

A. IMMEDIATE THREATS (2025-2026)

Electronic Warfare Escalation

Increased GPS/GNSS jamming frequency

Satellite communication disruption operations

Ground station cyber attacks

Commercial satellite network exploitation

Orbital Debris Weaponization

Kessler Syndrome risk from kinetic ASAT tests

Deliberate debris field creation as area denial

Critical orbital regime access denial

Non-State Actor Threats

Non-state actors leverage low-cost satellites for reconnaissance operations

Commercial space technology accessibility increases threat actor diversity

Dual-use risks from commercial satellite exploitation (SpaceX Starlink co-opted by Russian forces)

Ukraine Conflict Space Warfare Precedents

Ukraine kinetically attacked Russian satellite ground stations

First documented ground station kinetic attacks in warfare

Demonstrated vulnerability of terrestrial space infrastructure

80% of commercial satellite tasking now originates from Ukraine-related operations, demonstrating unprecedented reliance on private capabilities for active combat zones.

Intelligence Collection Compromise

Adversary ISR capability enhancement

Friendly force persistent observation

Geolocation capability development

Targeting data development acceleration

Recent launches:

U.S. GPS III – Navigation, ISR support: Offers 3× greater accuracy and 8× better jamming resistance than prior generations via M-code tech, enhancing PNT reliability for military and ISR operations.

China G60 Communications #72 – Communications, potential ISR: Part of the Qianfan (Thousand Sails) megaconstellation aiming for 648 satellites by 2025, 14,000 by 2030. Competes with Starlink by providing global LEO broadband.

China Tianlian-2 (05) – Relay for space ops: Latest in China’s 2nd-gen geostationary relay satellites, supporting TT&C for Tiangong station and other MEO/LEO craft, ensuring constant space-to-ground communications

B. MEDIUM-TERM PROJECTIONS (2026-2030)

Orbital Strike Capability Development

Space-based global strike systems

Sub-90-minute point-to-point engagement capability

Nuclear orbital weapon deployment risk

Boost-phase missile defense from space

Proliferated Constellation Vulnerability

Mass satellite deployment target identification

System-wide disruption capability development

Commercial-military distinction erosion

Collateral damage calculation complexity

Space Mobility and Logistics

Orbital warehousing capability development

Suborbital cargo delivery systems

Rapid logistics enable for space operations

Sustained orbital combat capability

Future ISR Capability Projections

Space-based ISR advancement beyond troop movement tracking

Real-time threat detection and warning systems

Ballistic and hypersonic missile tracking capabilities

Quick deployment and coordination enablement for modern warfighting

Advanced ISR integration with automated decision systems

Challenges and Integration Issues

Commercial technology integration complexity

Spectrum and orbital resource management requirements

Cross-service and international interoperability needs

Policy, legal, and ethical framework development necessity

SECTION VI: OPERATIONAL IMPLICATIONS

A. MULTI-DOMAIN INTEGRATION REQUIREMENTS

Joint All-Domain Command and Control (JADC2)

Space-based global communication links necessity

Rapid data transmission capability

Decision-making acceleration in contested environments

Sensor-shooter-decision maker connection across domains

Combat Proven Applications

Israel Arrow-2: first recorded space warfare intercept (October 2023) - Houthi ballistic missile intercepted outside Earth's atmosphere

Iran 2024 missile barrage: space-based defense validation

Ukraine Starlink utilization: real-time drone strike coordination

Russian Oreshnik MIRV-equipped missile deployment (2024): missile defense paradigm challenge

Russia-Ukraine Conflict: Starlink provided real-time communications for drone strikes while Russian forces exploited Starlink access, exposing dual-use risks

B. BUDGET AND RESOURCE ALLOCATION

U.S. Space Force Budget (2024)

Total budget: $30 billion (22% increase from 2023)

Research and Development: $19.2 billion (64%)

Procurement: $4.7 billion

Congressional oversight: 2022 NDAA GMTI spending limitations

Proliferated Architecture Investment

Space Development Agency: >100 satellite launches planned 2025

Proliferated Warfighter Space Architecture expansion

Commercial capability integration acceleration

Allied partnership development funding

SECTION VII: ASSESSMENT AND OUTLOOK

A. KEY INDICATORS AND WARNINGS

Escalation Indicators:

Kinetic ASAT Proliferation: 7 destructive tests by Russia, China, and India since 2007 generated 6,851+ debris objects (2,920+ active in 2025). Russia’s 2021 test and 2025 low-orbit missile test confirm persistent development despite U.S. moratorium .

Nuclear Orbital Weapons: Russia’s nuclear-armed co-orbital ASAT system development confirmed by allied intelligence; Belarus storage site near operational status.

Commercial-Military Integration: U.S. DoD allocated $900M for commercial satellite procurement (2025); SpaceX Starlink targeted by Russian jamming in Ukraine (2022–present).

Ground Station Attacks: 300% increase in GPS jamming incidents since 2023 (Russia, Israel); 3 physical attacks on Ukrainian infrastructure in Q1 2025

Capability Development Metrics:

Constellation Deployment: U.S./allied LEO satellites grew 242% (3,371 in 2020 → 11,539 in 2025); China plans 13,000-satellite Guo Wang by 2030.

Electronic Warfare: Russian Krasukha-4 and Chinese DN/EW-02 systems jam Starlink/GPS; U.S. achieves <24-hour EW countermeasure deployment via Project Convergence.

Orbital Maneuvering: Russia’s Luch/Olymp and China’s Shijian-21 conduct proximity operations; France/India advance docking capabilities.

Space-Based Weapons: U.S. deploys Counter Communications System; Russia tests "inspector satellite" projectiles (2017); China operates GEO jammers (2024).

B. LONG-TERM STRATEGIC IMPLICATIONS

Space Domain Control

Multi-Domain Nexus: Space-based GMTI/AMTI sensors enable hypersonic missile tracking (e.g., U.S. HBTSS for $175B Golden Dome). Loss of space C2 degrades >70% of U.S. precision strike capacity.

Deterrence Erosion: New START expiration (Feb 2026) enables Russian warhead surge by 60%; nuclear ASATs violate Outer Space Treaty.

Power Projection Dependency: U.S. Space Command doctrine mandates "space superiority" for major ops; China’s Information Support Force (2024) mirrors integration.

Commercial-Military Convergence

Dual-Use Dominance: 71% of $415B space economy (2024) commercial; Iridium 5G NTN (2026) blurs civilian-military boundaries.

Private Sector Warfare: SpaceX conducted 138/145 U.S. launches (2024); Palantir/Anduril supply AI targeting. Commercial outages risk mission failure.

Legal Fragmentation: No international jamming/cyber norms; Russia blocks UN resolutions; commercial operators lack treaty standing.

CONCLUSION

Analysis indicates space-based ISR has completed transition from intelligence support function to critical warfighting capability. Current trajectory suggests space superiority achievement will determine terrestrial military campaign success by 2030. Convergence of commercial innovation, new operational doctrines, and emerging threats demands unprecedented integration of space capabilities into joint operations.

failure to maintain space domain superiority risks ceding ultimate strategic high ground to adversaries. Current gray-zone warfare activities indicate preparation for potential kinetic space conflict. Immediate action required to preserve U.S. and allied space superiority through resilient architecture development, defensive capability enhancement, and allied integration acceleration. Kinetic testing moratoriums are failing, and legal frameworks are outdated.

Space ISR evolution from passive intelligence collection to active warfighting enabler represents fundamental shift in military operations. Bottom line is that space dominance is irreplaceable for terrestrial victory, with commercial infrastructure forming the backbone of military ops. Space domain control now prerequisite for terrestrial campaign success across all operational environments. China/Russia pursue asymmetric counterspace capabilities (nuclear ASATs, EW) to offset U.S. constellation advantages.