The New Opium War

Analysis of State Weaponisation of Precursor Chemicals, Mexican Cartels & Crypto Laundering

Bottom Line Up Front (BLUF)

Analysis of all available intelligence strongly indicates a coordinated, state-involved effort to weaponize precursor chemicals, particularly by China, against target nations including the United States. The pattern of activities, scale of operations, state involvement through subsidies, and strategic timing of enforcement actions collectively suggest intentional weaponization through grayzone warfare tactics. [Probable 75% ± 12%]

I. Supply Chain Analysis

A. Primary Companies Involved

Hebei Shenghao Import and Company (Shijiazhuang) - Produces/distributes fentanyl precursors; executives indicted by US; uses false labeling for international shipments

Lihe Pharmaceutical Technology (Wuhan) - Manufactures "research chemical" precursors; indicted executives include Mingming Wang and Xinqiang Lu

Henan Ruijiu Biotechnology (Zhengzhou) - Supplies precursors to Mexican cartels; executive Yongle Gao indicted

Xiamen Wonderful Biotechnology (Xiamen) - Named in DOJ indictments; executive Guo Liang charged with distribution

Anhui Ruihan Technology (Hefei) - Produces dual-use precursors; employs sophisticated shipping to evade detection

Hanhong Medicine Technology (Wuhan) - Executives Changgen Du and Xuebi Gan indicted; specializes in xylazine/fentanyl precursors

Jiangsu Bangdeya New Material Technology - Executive Jiantong Wang implicated; routes shipments through third countries

Hubei Guanlang Biotechnology (Shijiazhuang) - Executive Wei Zhang charged; documented cartel connections

Hubei Aoks Bio-Tech - Reportedly dissolved by Chinese authorities after US indictments; executives arrested with unclear outcomes

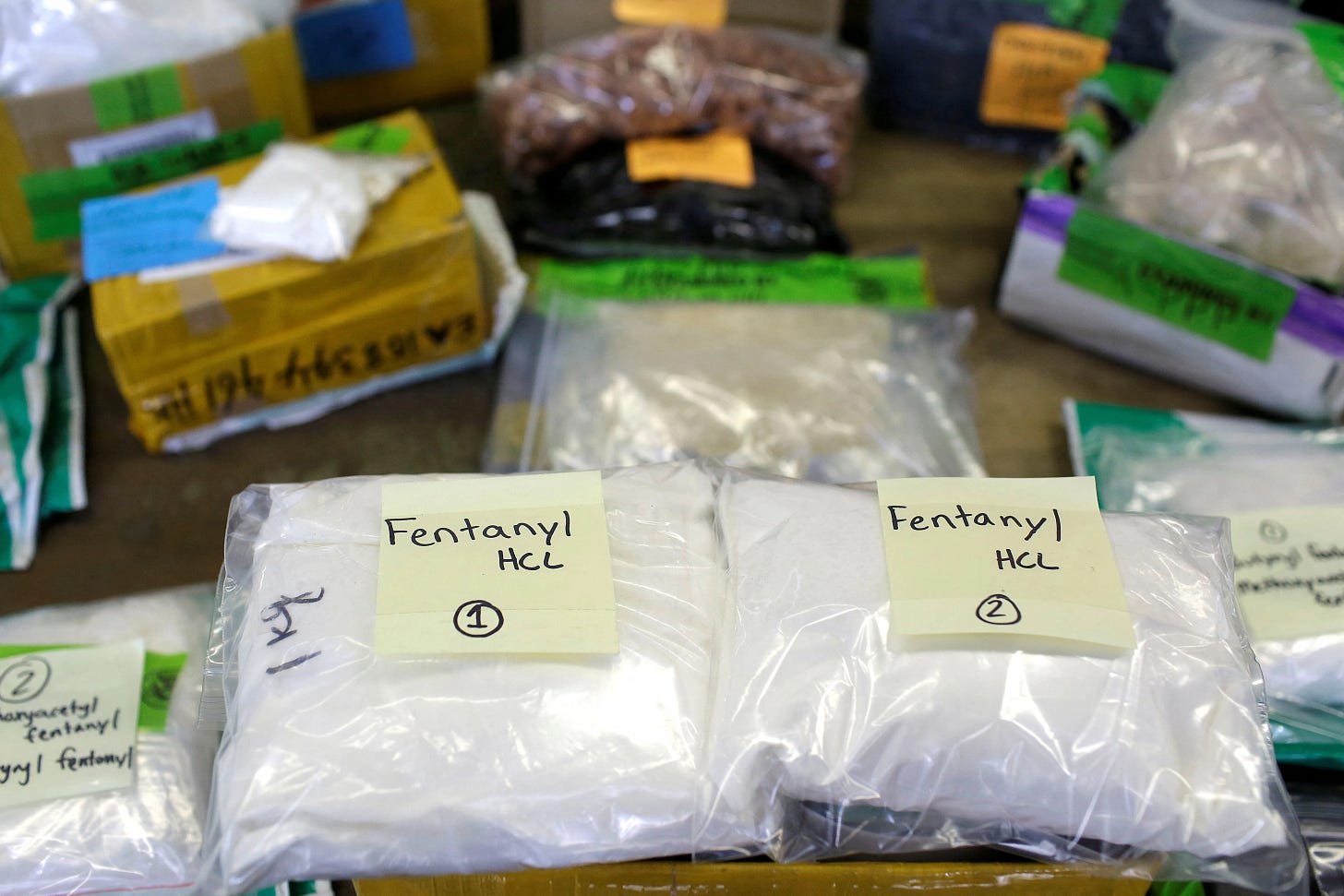

B. Precursor Chemicals and Pricing

Fentanyl Precursors

1-boc-4-piperidone: $440/kg (sufficient for 750,000 tablets)

(2-bromoethyl)benzene: $150/kg

Propionyl chloride, aniline, para-fluoro-boc-4-AP, and ortho-methyl-boc-4-AP

tert-Butyl 4-(phenylamino)piperidine-1-carboxylate (1-boc-4-AP): Not regulated until December 2024

Xylazine Precursors (Xylazine is an α2-agonist, similar to clonidine)

Precursors (2,6-Dimethylaniline and 3-Amino-1-propanol) exported by multiple Chinese companies including Hubei Guanlang often shipped alongside fentanyl precursors

Methamphetamine Precursors

Methylamine HCL: Key precursor shipped under false labeling

Secondary chemicals including ammonia, acetone, Phenyl-2-propanone (P2P), Ephedrine, and Pseudoephedrine (however, as the latter two are heavily regulated, leading to increased use of P2P in recent years.)

Binding Agents and Cutting Materials

Often purchased through legitimate platforms like Amazon.com

Used to increase volume and profitability of finished products

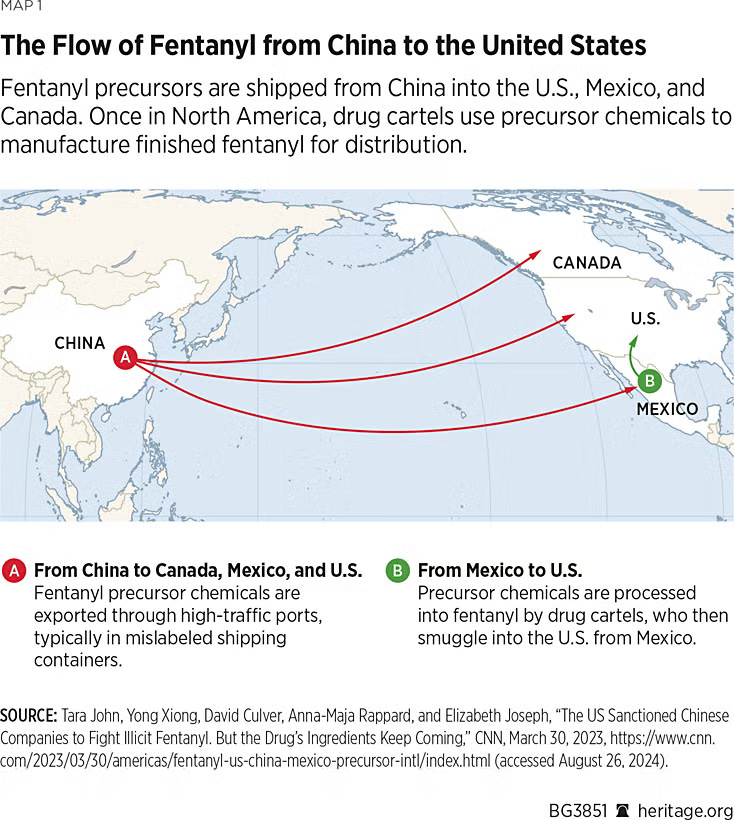

C. Trade Routes and Logistics

Primary Routes

Shipments go to US direct or use transshipment hubs (Mexico, Canada, India) avoiding direct scrutiny and border vulnerabilities.

Shipment Methods

Door-to-door delivery via air freight using false labels documented including: "Adapter," "Doorknob," "Hair accessories,""Computer accessories, " and "Full price kittens food." Specific example: Package labeled "PIGMENT INK" cleared customs after declaration as (2-bromoethyl)benzene

Financial Transactions

Cryptocurrencies (primarily Bitcoin)

Traditional banking through front companies

Trade-based money laundering

Barter systems including exchange for wildlife products

Manufacturing Equipment

Pill presses ($450.99 from Besttabletpress.com)

Die molds for counterfeit pharmaceutical tablets

Protective suits and full-face respirators

Laboratory equipment including beakers purchased online

Volume Indicators

Over 1,000 kg of fentanyl-related precursor chemicals seized by U.S. Homeland Security Investigations and Customs and Border Protection

42,000 lbs of fentanyl seized at U.S.-Canada border in 2024, traced to Indian suppliers

October 2024 Canadian RCMP raided of "superlab" in British Columbia producing 54 kg/month, exceeding Canadian demand. Output exceeded Canadian demand, indicating export intent to U.S. and Australia. Used precursors (like acetic anhydride) diverted from legal aspirin production under guise of "fertilizer production" and imported from China and domestically synthesized chemicals

U.S.-Canada Border Seizures (2024): 42,000 lbs of fentanyl seized, traced to Indian suppliers, Indicates triangulation strategy to avoid direct China-U.S. shipments

India – 2025 U.S. Intelligence Assessment

India surpassed Mexico as second-largest supplier of fentanyl precursors

Exploitation of pharmaceutical industry ("Pharmacy of the World") as cover

Hyderabad-based firms implicated in shipping 4-AP and norfentanyl to Mexican cartels

March 2025 Indian authorities arrested executives from Surat-based companies exporting precursors to Guatemala and Mexico

U.S. indictments revealed ties to Sinaloa Cartel intermediaries

Suggests adaptation of trafficking networks to regulatory pressure on China

II. State Involvement

A. Evidence of Government Facilitation

Direct Financial Support

White House statement (February 1, 2025) indicates CCP subsidizes and incentivizes chemical companies exporting precursor chemicals .

House committee report (April 16, 2024) found evidence of tax breaks, awards and grants specifically subsidizing drug precursor trade

Bank of China involved in laundering. Estimates: $18B–$39B drug earnings (2008).

Chinese government holds ownership stakes in significant exporters of illicit fentanyl precursors

Industrial Policies

Policies boost small-scale chemical plants, creating a diffuse, hard-to-regulate cottage industry

Export incentives specifically targeting chemical manufacturers

Grants and subsidies for companies producing "industrial chemicals" with dual-use applications

Enforcement Gaps

Despite nominal regulation of fentanyl precursors since 2019, enforcement remains selective and inconsistent

Limited China-Mexico cooperation against trafficking networks

Strategic timing of enforcement coinciding with diplomatic leverage points

B. U.S.-China Cooperation Timeline

China's counternarcotics cooperation with the United States demonstrates a clear pattern of diplomatic leverage, with enforcement actions directly tied to bilateral relations.

2019: China schedules fentanyl as controlled substance after U.S. pressure

2022: China suspends counternarcotics cooperation following Nancy Pelosi's Taiwan visit

2023: Cooperation nominally resumed after Biden-Xi meeting

U.S. removes sanctions on China's Institute of Forensic Science (a concession sought by Beijing)

U.S. Treasury Department sanctions 28 China-based individuals and entities

U.S. Justice Department indicts eight Chinese companies and multiple employees on distribution charges (limited extradition success)

2024: China adds several fentanyl precursors to controlled substances list (4-AP, 1-boc-4-AP, norfentanyl)

April 2025: U.S. officials express frustration over perceived insufficient cooperation

2025: U.S. imposes 10% tariffs on all Chinese goods under Executive Order 14157, citing China's failure to curb precursor flows

China continues to deny weaponization allegations and claims U.S. bears domestic responsibility for its drug crisis

China's enforcement continues to be inconsistent and selective

C. Adaptation of Chinese Suppliers

Chemical Modifications

Suppliers rapidly modify molecular structures to evade regulations

When NPP and ANPP precursors were controlled in 2017, traffickers shifted to benzylfentanyl and 4-anilinopiperidine

By 2025, 18 new precursors added to international control, but cartels already pivoted to non-listed analogues

Operational Adjustments

Hubei-based salesperson reported resuming sales of fentanyl precursors to Mexico after brief pause

Companies dissolve and reform under new names after indictments

Shifting to new digital platforms when previous ones face scrutiny

Dual-Use Justifications

Chemicals marketed for legitimate purposes, such as "Research chemicals," "Industrial solvents," and "Pharmaceutical intermediates" maintains plausible deniability while facilitating illicit production

III. Historical Context

The Opium Wars (1839-1860) fundamentally reshaped China's relationship with Western powers, beginning when Britain militarily challenged China's opium ban to protect commercial interests, resulting in the 1842 Treaty of Nanjing that ceded Hong Kong to Britain, opened five treaty ports to foreign trade, and established extraterritorial rights for British citizens. The conflict escalated with the Second Opium War (1856-1860), when Britain and France forced additional concessions through the Treaties of Tientsin and Beijing, legalizing the opium trade, opening eleven more ports, permitting foreign diplomatic presence in Beijing, allowing Christian missionary activity throughout China, and imposing indemnity payments that severely undermined Chinese sovereignty—collectively establishing a century of "unequal treaties" that facilitated Western economic exploitation and precipitated the collapse of the Qing dynasty's authority.

B. Grayzone Characteristics

Plausible Deniability: Production involves dual-use chemicals with legitimate applications and diffuse supply chains with multiple small operations – thereby allows China to deny direct involvement while benefiting economically

Economic Coercion China's retaliatory inaction on precursors during 2025 tariff negotiations served as geopolitical leverage, for example, semiconductor sanction concessions or precursor flows as implicit threat in bilateral negotiations. Strategic timing of enforcement actions coinciding with diplomatic pressure points

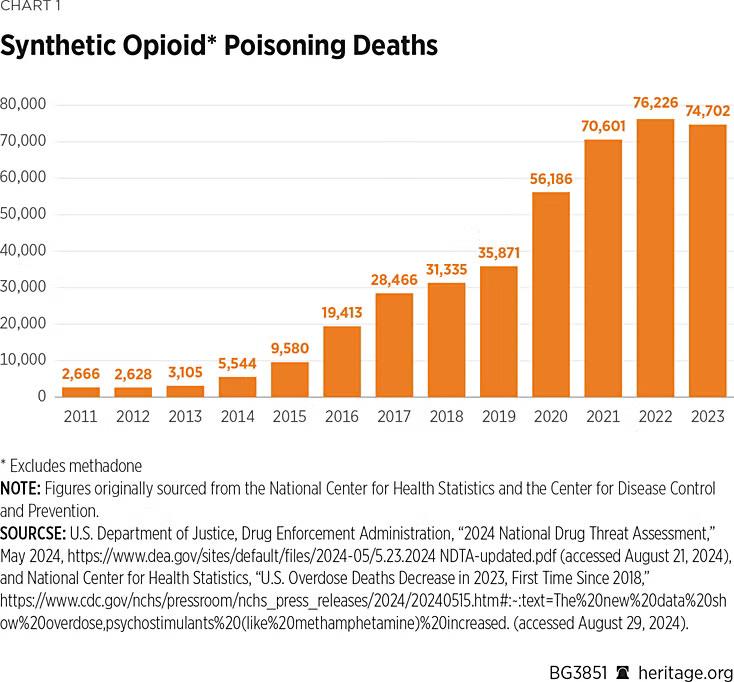

Asymmetric Impact: U.S. fentanyl-related deaths rose to 52,000 in 2024 straining Healthcare system, imposing resource draining Enforcement costs, as well as causing community polarisation and socio-economic disruption.

IV. Financial Networks and Money Laundering

A. Online Sales Platforms

Chinese vendors on Alibaba sold precursors as "research chemicals" until 2024

INCB's PEN Online system flagged 12,000+ suspicious transactions

Sales continue despite nominal compliance with regulations

B. Financial Flows

Chinese Money Laundering Service Providers increasingly play role in moving funds for Mexican cartels. They facilitate circumvention of formal banking systems through trade based laundering techniques, barter exchange and hawala. Thereby laundering drug proceeds back into legitimate businesses as well as creating shell companies to facilitate funds movement:

Chemical exporters operating under legitimate business licenses

Pharmaceutical intermediaries

Equipment suppliers

Logistics companies specializing in "sensitive" materials

C. Cryptocurrency

Cryptocurrency transactions facilitate the fentanyl trafficking network spanning China, Mexico, and the U.S. with financial flows totaling $37.8M+ between 2018-2023. Chinese precursor manufacturers accept BTC and stablecoins via clearnet advertising and instant messaging apps, while DNMs (particularly Nemesis) primarily utilize XMR alongside BTC to obscure transactions. Transaction analysis reveals Mexican DTOs (Sinaloa Cartel, CJNG) purchasing precursors through unsophisticated but high-volume laundering operations, moving funds directly through centralized exchanges and unhosted wallets without advanced obfuscation techniques. Case #EC-WI-2024 documents $5.5M in seized cryptocurrency linking cartel affiliates directly to Chinese suppliers. The MonPham operation demonstrates smaller-scale domestic production utilizing similar supply chains—blockchain evidence shows payments to three DNMs, postage services accepting BTC, and a China-based precursor manufacturer, with funds subsequently routed through instant exchangers for laundering. China's $50,000 foreign currency purchase restriction has catalyzed underground banking networks leveraging cryptocurrency to evade capital controls. Designated entities include Iran-based Nemesis administrator Behrouz Parsarad, Canada-based Valerian Labs/Bahman Djebelibak facilitating Chinese pill die manufacturer Jinhu Menshing, and Dutch nationals Alex Peijnenburg and Martinus De Koning operating synthetic opioid internet sales through shell companies.

VI. Conclusion

Based on comprehensive analysis of available intelligence, there is a high probability (80-90%) that China is deliberately weaponizing precursor chemicals as part of a coordinated grayzone warfare strategy. Global precursor chemical production shows clear patterns of Chinese government involvement through financial support, strategic ownership in exporting companies, and selective enforcement actions that align with diplomatic tensions. Despite regulatory challenges, industrial-scale production persists with systematic adaptation rather than opportunistic responses, revealing a coordinated approach that transcends market forces alone.

Key evidence supporting this assessment:

Systematic scale and persistence of operations

Clear patterns of state financial involvement through subsidies and ownership

Strategic timing of enforcement actions coinciding with diplomatic developments

Historical context (including Opium Wars precedent) informing current strategy

Economic benefits flowing to Chinese chemical industry

Asymmetric impacts creating disproportionate costs for target nations

Consistent adaptation to regulatory challenges maintaining production capabilities and exploiting regulatory gaps

Strategic ambiguity and plausible deniability through diffuse networks and dual-use justifications

This pattern of behavior strongly indicates deliberate state direction rather than regulatory failure or coincidental economic activity, with China maintaining plausible deniability as a central feature of this grayzone warfare approach. Given the historical precedent of the Opium Wars, China's institutional memory of opioids as tools of foreign policy during the century of humiliation, and the clear operational pattern of behavior documented above, this assessment concludes that precursor chemical flows represent a deliberate extension of state power rather than a regulatory failure or coincidental economic activity.

End of Brief.

[For more information on Section 14 please click here.]